Traditionally, investors have focused on generating the highest possible returns or beating the market, while staying within their comfort zones in terms of risk. My preference to wealth management is goal-based investing, which emphasizes investing with the objective of reaching specific life goals. Whichever approach you prefer, the important thing is to do something, and not just leave your financial health to chance.

Next, arrange your goals by the time horizon for achieving them. Do some research and take advantage of financial and retirement calculators available to put a value/cost on each of your goals.

After you define your goals and figure out how much money you need and when, the next step is to reverse engineer an investment strategy that will make it happen. An investment strategy is basically a plan of attack that guides your decisions based on your goals, risk tolerance, and future needs for capital. Some keys to making a sound investment strategy:

Start now. Seriously. Stop putting it off. Know what you’re looking for so that you are anchored by the must-haves and not distracted by the nice-to-haves. Take advantage of the power of compounding. Think twice before investing in anything with high costs/fees. Diversify your investments.

Investing for Cash Flow

You would need to have passive cash flow in excess of your net income If your goal is to eventually quit your job so you can spend more time with your family, Let’s say for example, you have $300,000 in a retirement savings account that you can invest. With that benchmark in mind, an investment that yields an 8% return would to generate roughly $24,000 in passive income. If you make $50,000 a year, you would need to invest over $600,000 in order for you to quit your job.

Investing For Appreciation

If you are more intrigued by the huge upswings in real estate values that have been seen in cities like San Francisco and can tolerate more risk because you are already generating plenty of income and you have a fair amount of assets generating multiple streams of passive income. You’re willing to gamble on the chance that you can time the market correctly and benefit greatly when the market has a huge upswing. You know the risk and are looking for investments in rapidly appreciating markets with a strong value-add component to maximize your chances for appreciation with a large lump-sum payout event even if you have to wait for it.

Investing for Cash Flow and Appreciation

Most investors are more comfortable with a combination of the two strategies. The best way to accomplish this is to look for investments that are in a growing market that provide some cash flow throughout the lifecycle of the investment, but there is also a chance to force appreciation by adding value to the property. This is the best of both worlds with less risk.

You have to be willing to put in some time and effort. It’s important that you understand the various types of retirement accounts and investment vehicles before risking any money. Do your homework; research your options because there are many!

-

Real Estate

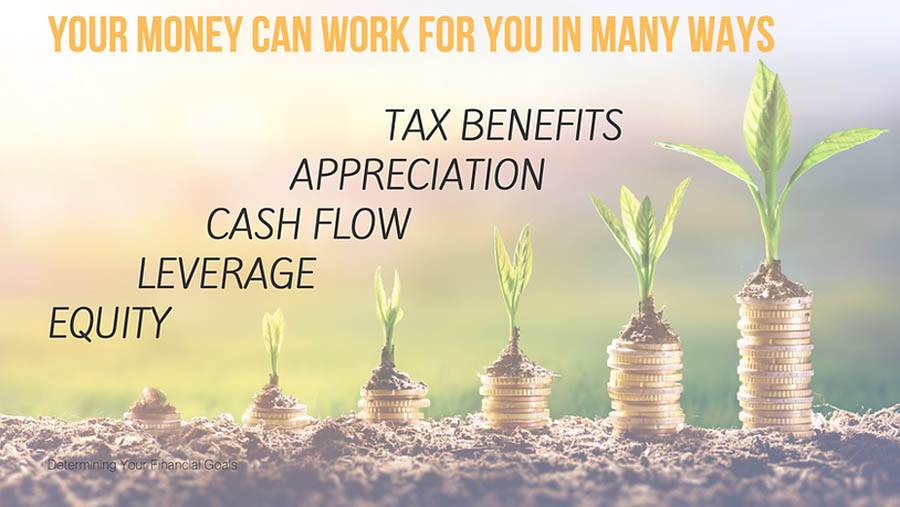

Why Real Estate Is the Smartest Investment In Our Opinion

Every dollar that you invest in real estate goes to work for you in more ways that one.

- Produces cash flow

- Uses leverage

- Gives you equity

- Can appreciate in value

- Amazing tax benefits

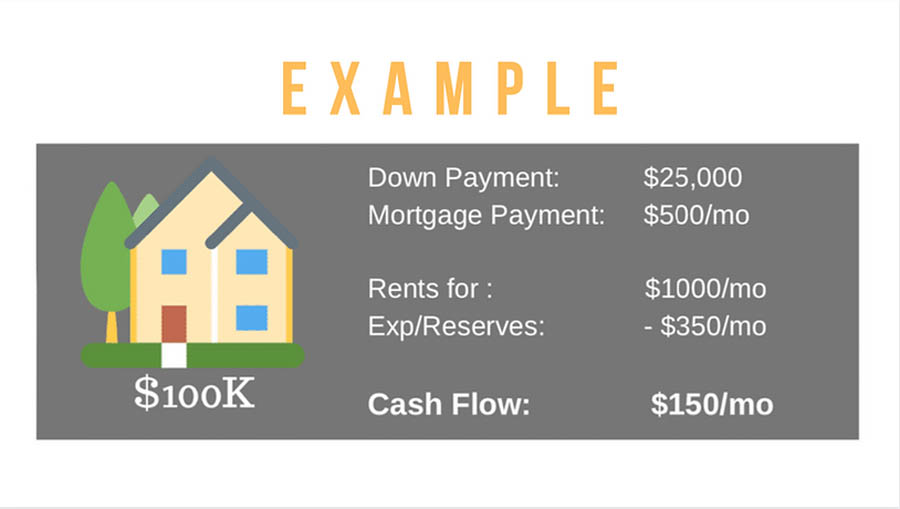

In this example, you bought a $100,000 property with only $25,000. The bank or other lender brings the other $75,000 to the table. The nice thing about leverage is the cash flow is based off of the full $100,000. You reap all the rewards even though the bank brought most of the money to the table. The bank is not going to give you 75% to buy stocks.

It gets better; every month you use the tenant’s money to pay your mortgage, and thereby increasing your equity in the property. Lets take this a little further. Once you build up significant equity in the property, you can use strategies like the cash-out refinance or you can take out a home equity line of credit (HELOC) against your own asset. This is tax-free by the way! You can then use those funds to invest in another cash flowing asset. Now your money has been cloned and is working twice as hard for you.

Real estate values tend to go up over time. When this happens it is referred to as appreciation. This is not always the case, but in 13 years, every real estate investment we have had increased in value every year even during the real estate crisis that started in 2008. While appreciation is nice to have, it’s not a guarantee, which is why we always buy for cash flow first and foremost.

Now, let’s talk about the tax benefits shall we? The tax code is written to reward and encourage certain types of investments. The government realizes that it needs investors to help provide safe, clean housing. When you invest in real estate, you get to take advantage of depreciation and mortgage interest deductions as well as all other related expenses. This will often create a “paper loss” allowing you to make more income, but pay less overall taxes. This one thing has made us hundreds of thousands of dollars over the years. Most people forget to add the tax benefits to the ROI of a potential real estate investment; this is not something you want to overlook.

For all these reasons, real estate is our investment vehicle of choice.

Keep in mind, being your own Financial Advisor doesn’t have to mean you go at it alone. I highly recommend that you find a mentor in each asset class that you choose to invest in. Education is the key!

If you decide that real estate is an investment vehicle you want to have in your portfolio, you need to decide if you want to be an active or passive investor. If you want to be hands – on and in complete control of your investment then you should consider rental property or fix-n-flips. If you want to be a hands-off passive investor where you are not dealing with tenants, turnover and toilets, you should really consider investing in real estate syndications of some sort.

We are here to help! Our mission is to help make it as easy as possible to invest in real estate. We know that the number one thing that all successful real estate investors say is that they should’ve started sooner! It is our goal to shorten the learning curve not only for our children, friends and family but also for anyone willing to follow our lead. We have done thirteen years and tens of thousands of dollars of hard work, education, mentors and seminars (life lessons) for you.

If you would like to invest with us, we would love to have you join our rapidly growing investor family!

The biggest thing, of course, is to approach your financial health with intention. Successful investing and meeting your short and long-term financial goals requires someone in the driver’s seat and that someone should be YOU!